Jasch Industries: A Quick Take on This Quiet Synthetic Leather Player

A rare integrated synthetic leather player in India. Stable demand, tricky economics—here’s what you need to know.

Today we’re unpacking a small but interesting company—Jasch Industries Ltd, a ₹130 crore SME focused on PU & PVC synthetic leather.

I’ve also shared a detailed video deep dive, where we go into numbers, and the full 20-factor scorecard.

But if you’re in a hurry, here’s a quick read to understand the business, the quirks, and what to watch out for if you’re curious about niche manufacturing plays like this.

Before we dig in

We’re opening a small, private group of just 20 serious microcap investors.

This isn’t about stock tips. It’s about structured deep-dives, unfiltered discussions, and learning together with a diverse set of long-term thinkers.

Applications close on 15th August.

Apply to join—or for any queries, write to us at hello@earlyedgeclub.com

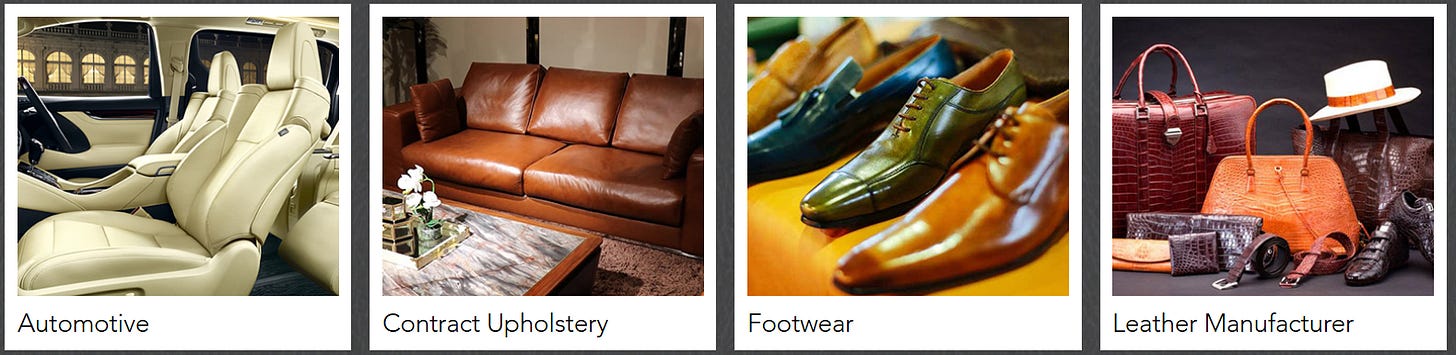

So, what does Jasch actually do?

Simply put, they make synthetic leather.

The seat covers in your car? Likely made of PU or PVC-coated fabrics like theirs.

The straps on your sandals, sports gear, upholstery? Again, similar material.

They even make PU resins that go into these coatings.

What’s interesting is Jasch is one of the few players in India who can make PU resins in-house. Most smaller manufacturers import these, so Jasch does have a bit of integration advantage.

How’s the industry looking?

The synthetic leather market in India is growing steadily—driven by autos, footwear, and furniture demand.

But… it’s tough. Why?

Raw material costs swing wildly with crude oil prices.

Chinese imports can undercut prices anytime.

And it’s a transactional business, not built on long-term contracts.

So, you have a stable demand backdrop but low pricing power.

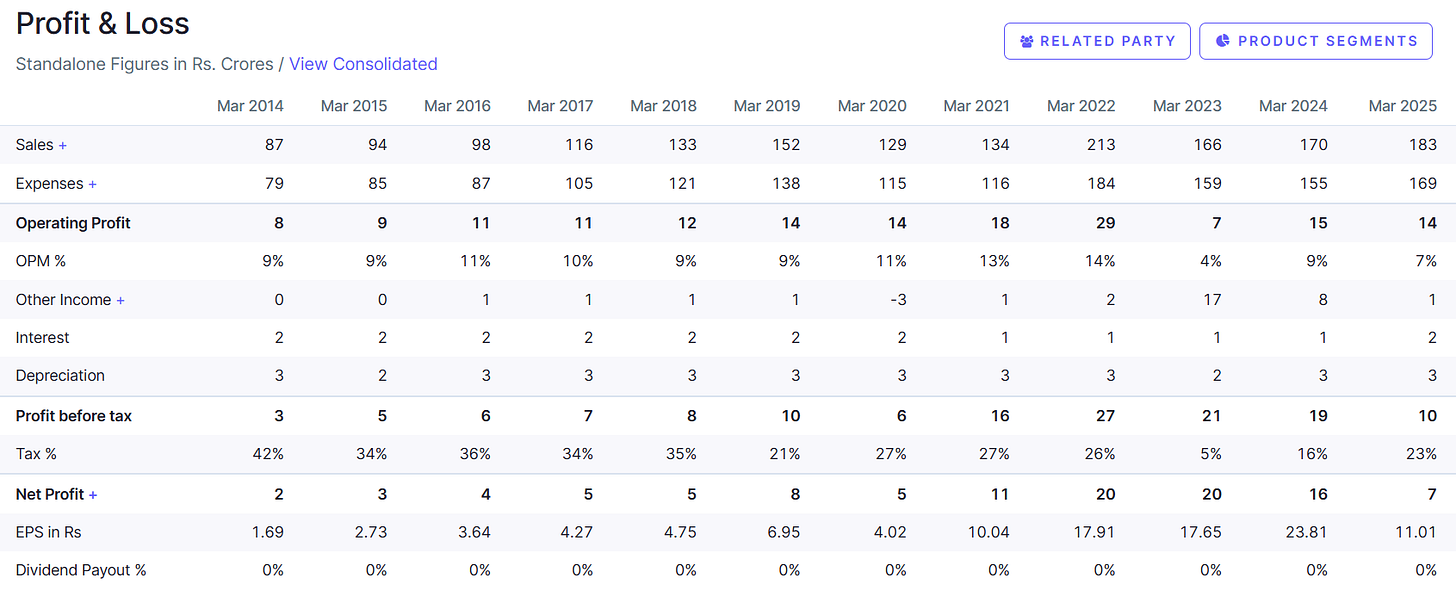

Quick snapshot of how Jasch has performed historically

Before we get into likes & risks, let’s see the bigger picture over the last few years:

Revenue has grown modestly, at around 7% CAGR over the past 5 years—not very exciting, but stable.

Margins (EBITDA ~7–14%) swing with crude oil prices, making profits volatile.

ROCE ~14–15% and ROE ~12–13%, decent for an SME but not exceptional.

Debt-to-equity is at 0.35, so leverage is reasonable.

Between FY22 and FY23, the topline movement is partly due to a demerger—the Electronic Thickness Gauge division (~30% of revenue) was carved out into a separate listed subsidiary.

So, Jasch has been a steady but not spectacular performer, very much in line with what you’d expect from a transaction-driven, low-pricing-power business.

What I like about Jasch

→ Integrated player—they make PU resins themselves, unlike most competitors.

→ Decent export presence in Europe and North America.

→ Good capital efficiency historically (high ROCE & ROE).

→ They’ve even tied up with a Japanese partner for niche PU tapes, which could help margins.

What are the risks?

→ No long-term contracts—sales are mostly repeat orders.

→ Margins fluctuate with crude prices—if input costs spike, profits shrink fast.

→ Chinese competition—cheap imports can hurt volumes & pricing.

→ Family-dominated board—not always bad, but governance transparency is limited (no investor presentations, no con-calls).

As a microcap investor, how do you look at such businesses?

When you see a company like Jasch, here’s the mental framework I’d suggest:

Is the business cyclical or structural? → Jasch is cyclical.

Do they have pricing power or just volume growth? → Mostly volumes, pricing is weak.

Are they integrated enough to withstand competition? → Slightly better than peers, but still exposed.

What’s the succession & governance like? → Family-run SMEs need careful monitoring.

Sometimes these are “ride the cycle” businesses. You don’t expect a 20-year compounding story here—but they can give short-to-medium term opportunities when valuations are reasonable and raw material cycles are in your favor.

My quick take?

At current levels, Jasch looks fairly valued, not a screaming buy. It’s a reasonable SME niche play, but there are better long-term structural stories out there.

If you’re tracking this space, watch input costs, Chinese imports, and how their premium product lines scale up.

If you found this quick take interesting and want a more detailed breakdown—covering the business model, valuation scenarios, risks, and our full 20-factor scorecard—do check out the video.

So, What do you think about such cyclical niche SMEs?

Worth a place in a portfolio—or better to stick with more scalable moats?

Drop your thoughts below!

Subscribe to Early Edge Club for more calm, research-first deep dives on microcaps.

Disclaimer:

At Early Edge Club, we define microcaps as companies with a market capitalization of below ₹3,500 crores.This video/article is for educational purposes only and should not be considered investment advice or a stock recommendation. Always do your own research or consult a SEBI-registered advisor before making any investment decisions.