The One Thinking Habit That Changed How I Analyse Stocks

How second-order thinking helps me build conviction in overlooked microcaps.

Here’s something I wish I’d realized sooner as an investor.

Most investors—including me, back when I started—tend to stop at the surface. We see a headline, a quarterly result, maybe a management interview on CNBC, and go:

“Okay, this happened. Got it.”

For the longest time, I thought that was enough. React fast, move on, repeat.

But over time—through wins, mistakes, and just observing what actually works—I realized something:

The investors who consistently spot the real multibagger opportunities? They ask a better question:

“What happens next because of this?”

That one mental shift changed how I analyze stocks—especially microcaps.

In this space, where analyst coverage is limited—and where misinformation and noise often dominate social media—thinking one step ahead gives you a real edge.

That, in simple terms, is what Second-Order Thinking is all about.

And here’s something else I’ve noticed:

It naturally builds long-term thinking into your process.

→ You stop reacting to headlines.

→ You start tracking business progress over years.

→ You stop worrying about what the stock did this week—and focus on what the company could become in the next 3–5 years.

It’s about looking beyond the obvious—and anticipating the ripple effects the market hasn’t priced in yet.

One quote that really brought this home for me comes from Howard Marks:

“First-level thinkers see what they think is a good company and decide to buy.

Second-level thinkers see the crowd is enthusiastic about the good company and, therefore, believe it is overpriced and proceed to sell.”

That’s the shift.

One is reacting to what’s visible.

The other steps back, reads the room, and anticipates what might unfold next.

Before we dig in

We’re opening a small, private group of just 20 serious microcap investors.

This isn’t about stock tips. It’s about structured deep-dives, unfiltered discussions, and learning together with a diverse set of long-term thinkers.

Applications close on 15th August.

Apply to join—or for any queries, write to us at hello@earlyedgeclub.com

Second-Order Thinking in Action (The Real Way I Use It)

I could show you backdated success stories. I could point to hindsight analysis and make it look like I had it all figured out. But that’s not what this blog is about.

So instead, let me share something real—how I’ve analyzed Ice Make Refrigerator over the past months using second-order thinking.

And yes—this could age terribly. I might be hated a few years down the line if it doesn’t play out the way I imagined. Or appreciated if it does. Either way, I’ll be honest.

“In the business world, the rearview mirror is always clearer than the windshield.”

— Warren Buffett

Finally, this is not a stock recommendation. It’s just a window into how I personally think about microcaps—and how I try to connect dots.

So, let’s dive in.

1. Market Shift → Silent Market Share Gains

First-order thinking:

Big refrigeration companies will own the market. Smaller players won’t matter.

Second-order thinking:

But wait—where are the big guys focusing?

Which segments are they ignoring?

Where is demand growing fastest, but competition still fragmented?

That’s where Ice Make quietly steps in.

They’re not trying to out-muscle multinationals. Instead, they’ve built deep moats in niche, sticky sectors like dairy, food processing, and pharma—industries where agility matters more than scale.

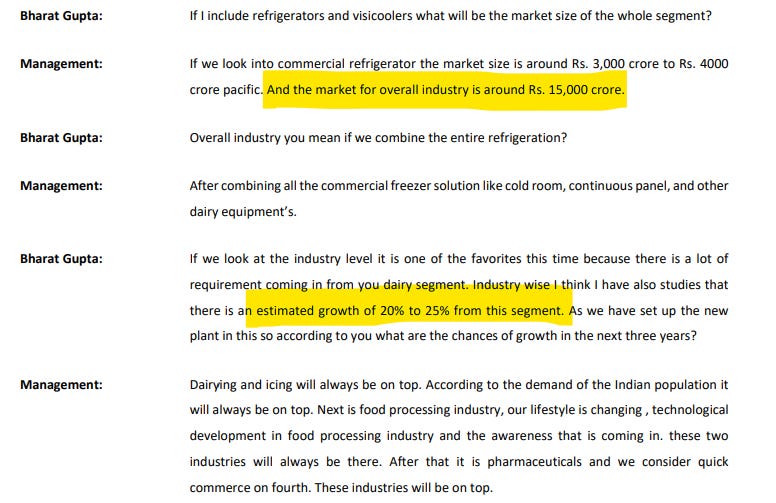

According to management, the total addressable market is around ₹15,000 crore—with commercial refrigeration (cold rooms, visicoolers, etc.) forming ₹3,000–₹4,000 crore of that.

But here’s the kicker:

Segments like dairy are expected to grow at 20–25% CAGR.

And Ice Make’s new capacity positions it right in the middle of that growth wave.

2. Policy Support → Structural Tailwind

First-order thinking:

“Policy support = obvious winners like big infra, listed agri giants, or capital-heavy players like cement and steel.”

Second-order thinking:

But where does this policy money actually flow first?

Which companies are positioned to capture demand without waiting for massive project bids?

Who has the distribution, product mix, and capex readiness to serve the next layer of customers enabled by these policies?

And without grabbing headlines, Ice Make becomes the go-to choice for these emerging needs.

They're not building highways or giant factories—but they’re perfectly placed at the convergence of three expanding policy-led trends:

Food security & agri infra → Cold chain for dairy, seafood, meat

Energy efficiency norms → Solar-powered cold rooms, eco-design mandates

Make in India push → Demand from local MSMEs, FPOs, and regional distributors

These policies unlock a massive underserved market—enabling small farmers, FPOs, and regional businesses to adopt cold-chain solutions for the first time.

And Ice Make, with its nimble structure and existing presence across Tier-2 and Tier-3 ecosystems, quietly becomes the default vendor.

That’s not a policy play. That’s a distribution moat with long-term optionality.

3. Valuation Looks High → But Isn’t

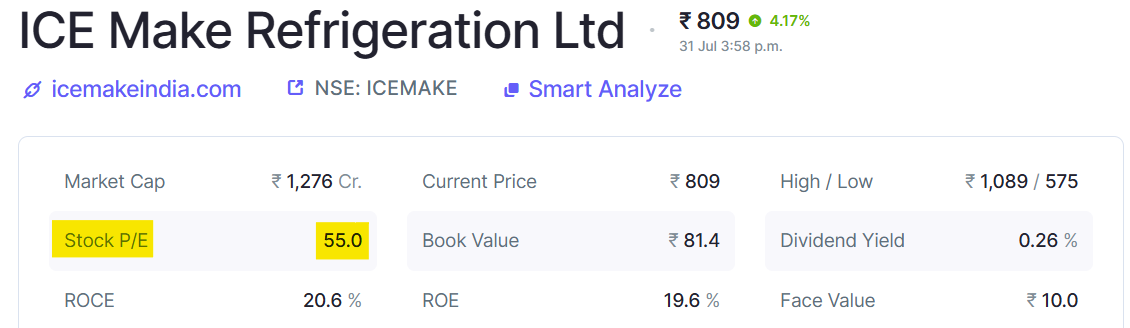

First-order thinking: "P/E 55? Way too expensive."

Second-order thinking:

That’s fair—if you’re looking only at trailing numbers. But what if earnings are about to inflect?

In the FY25 con-call, Ice Make’s management guided for:

FY26 Revenue: ₹650 crore

EBIT margins: 9.5% to 10.5%

That implies:

EBIT: ₹62–₹68 crore

PAT (conservative est.): ₹33–₹39 crore

EPS range: ₹21–₹25

At the current price (~₹800), that translates to a forward P/E of ~32x to 38x—and that’s without assuming any upside surprise in margins or operating leverage kicking in harder.

So yes, today’s 55x looks high. But second-order thinking in me asks:

But what if the valuation is high because the market is starting to price in margin expansion and scale?

What if today's P/E is just a reflection of tomorrow's earnings?

When you factor in where Ice Make could be 12–18 months from now, the current valuation starts to look less like excess—and more like priced-in anticipation.

And when your time horizon stretches beyond just the next quarter or two, that’s where the real compounding begins.

Because short-term volatility often masks the real story—while long-term value quietly builds underneath.

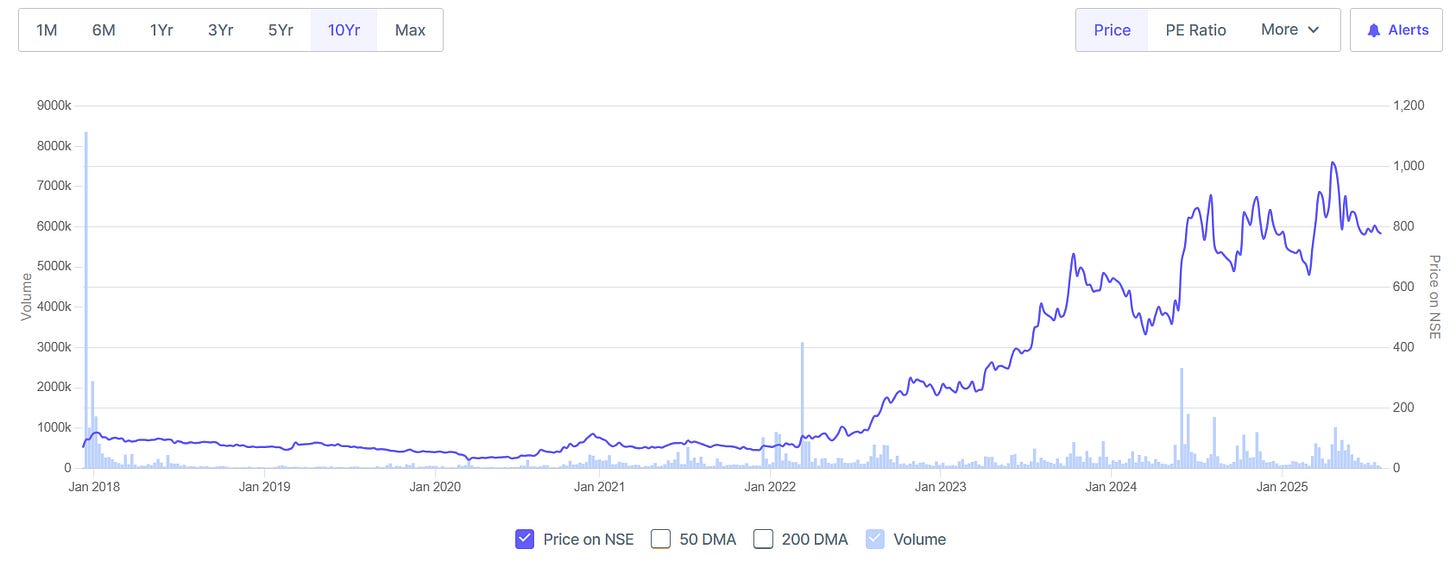

4. 10x in 5 Years → Still Room to Grow?

First-order thinking: "It’s already up 10x. I’ve missed the bus."

Second-order thinking:

But here’s what I ask instead:

→ Has the market rerating already played out? Or is the business model still in early innings of scaling?

→ Have the fundamentals peaked? Or are we just entering year one of the next growth phase?

For Ice Make, I believe it’s the latter.

Yes, the stock is up ~10x since listing. But look beneath the price:

Revenue CAGR since IPO is ~22%

Base remains small relative to a ₹15,000+ crore addressable market

Capex-led capacity expansion is just going live

Policy tailwinds are unlocking newer customers (FPOs, agri, pharma)

Margin levers (9.5%–10.5% EBIT guided) are only now taking shape

Export opportunity is still underexplored—but beginning to open up

In my experience, multi-year compounding stories often get misread after a 5x or 10x move—because people focus on the chart, not the runway.

For me, the question wasn’t “What’s already happened?”

It was: “What’s priced in—and what’s not?”

5. Not Fluent in English? → But Fluent in Capital Allocation

First-order thinking:

“Management doesn’t speak fluent English… and they’re not from IITs, IIMs, or top engineering colleges. Can they really scale?”

Second-order thinking:

That was my early bias too—until I started judging by execution, not accent.

Both Chandrakant and Rohit Patel—the promoters of Ice Make—are Commerce graduates, not engineers or MBAs. Their con calls are mostly in Hindi, and they don’t sound like your typical “institutional-ready” promoters.

But here’s what does sound right to me:

Promoter holding: 74.4%

Capex: ₹200 Cr expansion done without equity dilution

Debt/Equity: Healthy at ~0.64

Communication: Steadily improving with investor decks, earnings calls, and margin guidance

So I asked myself:

→ Do I want polish and pedigree? Or proof of execution and capital discipline?

They may not have the gloss.

But they definitely have the grit of builders.

It actually reminds me of Warren Buffett’s investment in Nebraska Furniture Mart, where he backed Rose Blumkin, a Belarusian immigrant who didn’t speak fluent English and had no formal education.

And yet—she built one of the largest furniture stores in America.

No MBA. No pitch deck. Just instinct, frugality, and customer obsession.

By the way—if you're curious to dig deeper into Ice Make, check out our full breakdown video covering everything: the business model, valuations, promoter signals, and how it scores on our 20-factor microcap checklist.

Final Thoughts

Second-order thinking isn’t some secret hack.

It’s just a better habit. A mindset shift. Asking:

“What could this lead to… and has the market fully seen it yet?”

And in microcaps—where analyst coverage is thin, information spreads slowly, and rerating often comes late—this kind of thinking can tilt the odds meaningfully in your favor.

With Ice Make, I’m not claiming to have cracked the code.

What I’ve done is put my second-order thinking to work—connecting a few signals that stood out to me: self-funded expansion, policy tailwinds, niche market share gains, disciplined promoters, and improving margins.

Could I be wrong? Absolutely.

Could the market rerate faster—or slower—than I expect? Sure.

But this is how I think through it. This is how I invest.

For full transparency, yes—I hold Ice Make in my personal portfolio. Entry price around ₹800. Five-year view. You can judge me then. If facts change, so will I.

Also, just to clarify:

I haven’t discussed the risk factors in this piece—not because they don’t exist, but because that’s a full post on its own. Every thesis deserves a devil’s advocate.

This isn’t a stock tip. It’s a window into the process.

And If You Made It This Far…

Thanks for reading. If this gave you a new lens to think through investing mindset—or just made you pause and reflect—I’d love to hear from you.

Drop a comment. Tell me where you agree, where you don’t, or what you’re seeing that others might be missing.

And if you want more deep-dive posts like this—real frameworks, real case studies, and raw thinking from the trenches— hit subscribe so you don’t miss the next one.

Wonderful post Suraj! I've (sometimes!) successfully tried this principle, though not as well as you have articulated..

My friend had intuitively told me that "If you don't have 2-3L per pick, even a 3-5x is meaningless "

But, fantastic piece, and do keep writing buddy.. You do this SO well!

A very good read Suraj. Liked the fact that you have covered the subject comprehensively. It’s worth noting that even those who understand probabilities and payoffs often overlook careful portfolio construction at the start. I guess our brain gets excited by the discovery and research and pay offs etc. which probably makes us ignore the " application" part