Your Multibagger Doesn’t Matter (If Your Portfolio Sucks)

The Lie of Multibaggers — Why Stock Picking Isn’t Enough

Before we dig in

We’re opening a small, private group of just 20 serious microcap investors.

Applications close on 15th August.

Apply to join—or for any queries, write to us at hello@earlyedgeclub.com

In my early investing days, I was obsessed with finding great stocks.

I’d spend hours researching small, under-the-radar companies — hunting for the next Page Industries, the next Eicher Motors.

And every time I built a thesis or bought into a new idea, it felt like this one could be it.

It’s funny — once you’ve done the work, almost every stock starts to look like a potential multibagger.

But here’s the truth I learned the hard way:

Finding great stocks is only half the game. The other half is building a portfolio that can actually convert those picks into wealth.

And I was failing at the second half.

Some of my picks worked.

A few doubled or tripled over a few years.

Others went nowhere. Many quietly bled red.

Despite the occasional winner, my overall portfolio returns were underwhelming.

Not because I couldn’t pick good stocks.

But because I had no real approach to portfolio construction.

No sizing strategy.

No diversification framework.

No clarity on how to allocate risk or how many positions to hold.

FOMO made me chase. Ego made me hold. Hope made me freeze.

When tax season rolled around and I finally checked my returns, I realised they were barely beating the largecap index. Honestly, I would’ve been better off just buying a low-cost index ETF — with less effort, less stress, and more consistency.

That’s when I realised:

It’s not whether one or two of your stocks do well. It’s whether your portfolio compounds.

In today’s investing world — where hype dominates headlines — this nuance is often lost.

“This SME IPO is a 10-bagger!”

“Stock X is up 500%!”

But no one talks about the 8 other stocks sitting in red, quietly dragging down your entire return profile.

The real question isn’t:

“Did you find a multibagger?”

It’s:

“What did it do for your overall portfolio?”

As Stanley Druckenmiller once said:

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

That’s not just a quote about conviction.

That’s about position sizing, risk allocation and strategy.

And this is even more important in the world of microcaps and SMEs.

Because in this space:

Volatility is brutal

Liquidity can vanish overnight

Sentiment flips in a day

And the odds of blow-ups are higher than any investor wants to admit

But the upside? It’s real. It’s powerful.

And it can work — if you know how to build around it.

These two quotes from Ian Cassel capture the essence of what most microcap investors overlook:

“The more you know what you own, the more volatility goes from being a risk to an opportunity.”

“Being a great stock picker means nothing if you can’t build and manage a great portfolio.”

And he’s right.

Because knowing what you own isn’t enough.

You also need to know how much to own.

Even the best stock in the world won’t change your net worth if you’ve sized it wrong.

And that’s what this post is really about.

Helping you shift from being a stock collector to a portfolio builder — especially in the microcap space where risk, reward, and liquidity behave very differently.

So Why Microcaps & SMEs Need Their Own Portfolio

Back then, I thought I was being smart.

I’d build what looked like a balanced portfolio — mostly stable largecaps, a few mid and smallcaps.

And then… I’d sprinkle in a microcap or SME here and there.

Maybe 0.5% to 1% of my capital into “promising” small companies.

A side-bet.

A lottery ticket.

A maybe-this-turns-into-Page-Industries play.

I told myself I was participating in the microcap space.

But looking back?

I wasn’t really investing in microcaps. I was just decorating my portfolio with them.

Let’s say one of those 1% bets went 5x in 5 years — a phenomenal outcome.

You turn that sliver into something bigger.

But when you zoom out…

That 1% turning into 5% barely nudges your overall portfolio.

It doesn’t move the needle.

And here’s where it gets worse — the probabilities.

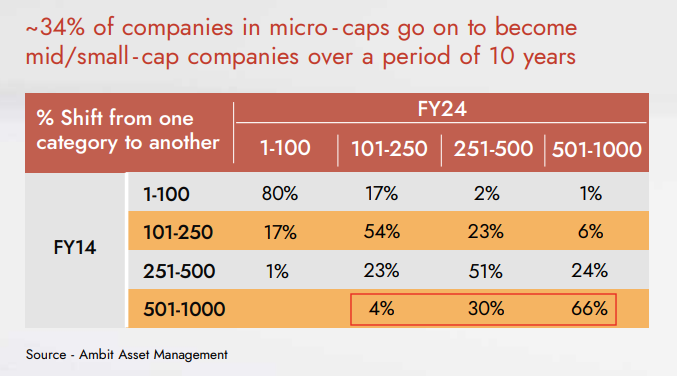

According to a 10-year study by Ambit Asset Management:

Only 4% of microcaps became midcaps

Around 30% became smallcaps

And a staggering 66% stagnated or failed

So even if you do pick a winner, chances are:

You sized it too small to matter

Or you held a few duds alongside it that quietly dragged you back to mediocrity

And the more I thought about it, the more it hit me:

I was doing the research.

I was studying filings, tracking management, building conviction.

But then… I’d allocate like I barely believed in the idea.

I’d repeat the same behavior:

One microcap here. Another there.

All under 1% of my portfolio.

Meanwhile, my core portfolio — delivered index-like returns — predictable, but unremarkable.

I was giving lottery-ticket allocations to my highest-conviction ideas.

And bulk capital to my least exciting ones.

That’s when the mental shift happened and I realised:

If you want microcaps to contribute, you need to give them a real seat at the table.

Not as side-bets.

The Shift: From Side-Bets to Portfolio Strategy

Eventually, the realization hit me — I had to stop asking, “Is this a good stock?” and start asking...

“How should microcaps fit into my overall approach?”

And once I reframed the question, the answers became clearer:

I needed a dedicated basket.

I needed wider diversification across bets.

I needed risk-adjusted sizing.

I needed rules for liquidity, exits, and conviction.

I needed higher selectivity — the discipline to say no 98% of the time.

I needed to accept that not all positions deserve equal weight — some are starters, others are benchwarmers.

And I needed to build a system that could absorb drawdowns without derailing long-term compounding.

Once I reframed that, everything changed.

I realised I needed:

A dedicated basket for microcaps and SMEs

Wider diversification across 15–25 bets

Risk-adjusted sizing, so one loser wouldn’t blow me up

Clear rules around liquidity, conviction, and exits

Initial position size of 3–7%, depending on my conviction.

And finally, the discipline to let winners ride — and prune the losers without emotion

Because here’s the truth:

If your edge is early identification…

Then your risk is early misjudgement.

And the only way to survive that risk — is portfolio construction and discipline

And The Numbers Prove It

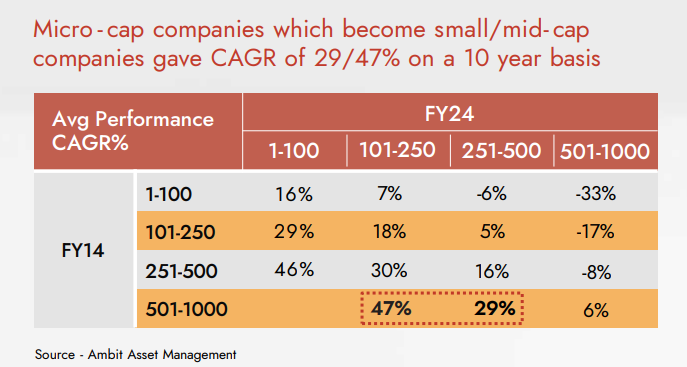

Ambit’s same 10-year study showed:

Microcaps that became smallcaps delivered an average 29% CAGR

Those that graduated to midcaps? A whopping 47% CAGR

But the average for all microcaps, including the failures? Just 6% CAGR

So yes — the upside is real.

But so is the casualty rate.

And unless you build your portfolio to catch the rare 5x or 10x and survive the 50%–70% drawdowns in the rest… you don’t get the reward.

Side Note:

This study covered the period up to mid-2024 — and as we all know, the 2020–2024 period saw a massive microcap and SME bull run.

If you re-ran the same test today, am sure the success rates would likely be significantly lower.

That makes portfolio structure — diversification, position sizing, and exit planning — even more critical going forward.

How Should a Retail Investor Play Microcaps & SME Stocks?

Once you realise that microcap and SME investing is a completely different game, the natural next question is:

“So how do I actually go about it?”

The right approach depends on three things:

your portfolio size, risk appetite, and intent level.

Based on my own experience — and what I’ve seen work for others in this space — here are two practical frameworks you can consider.

But remember: this isn’t a one-size-fits-all game.

Do your own due diligence, and make sure your approach matches your personal circumstances, emotional temperament, and financial goals.

Because let’s be honest —

Microcap investing isn’t for everyone.

It requires patience, discipline, and the mental strength to sometimes look wrong before you're proven right.

1. The Core–Satellite Portfolio Approach

(For investors who want microcap exposure, but still want a safety net)

If you're a first-time investor looking to get serious about microcaps, this is the approach I’d recommend starting with — because it’s exactly how I began.

Before going “all in” on microcaps, I used this framework to learn, build conviction, and develop emotional resilience — without risking everything on day one.

Structure:

Core Portfolio (70–80%):

Largecaps, mutual funds, midcaps — the stable foundation.Satellite Portfolio (20–30%):

Microcap exposure — 6–10 well-researched positions.

Why it works:

Limits damage if microcaps underperform

Provides asymmetric upside if even one or two stocks break out

Emotionally easier to manage during drawdowns

Lets you “test and learn” without compromising your overall wealth

But is a 20–30% sleeve too small?

Not necessarily.

Let’s say your satellite portfolio is ₹3 lakh inside a ₹10 lakh total corpus.

You invest in:

6 microcap stocks at ₹50k each

One of them becomes a 5x over 5 years

Two others double

The rest go nowhere or decline

That alone could generate 15–18% CAGR for the satellite sleeve, and pull your overall portfolio returns up by 2–3% CAGR — enough to outperform most index funds, especially when combined with a solid core.

And most importantly, it gives you the emotional and strategic practice needed to grow into a more active microcap investor.

Quick Note on SME Stocks:

For smaller satellite portfolios, it's best to avoid SME stocks in the beginning.

Due to large lot sizes, a single SME can eat up too much capital and skew your allocation.

Unless your satellite sleeve is ₹10 lakh+, it's better to stick with listed microcaps on the main board — they offer better liquidity and more flexible sizing.

2. The Microcap Specialist Portfolio

(For experienced investors who want to actively build alpha)

Structure:

Dedicated capital: ₹25–50 lakh+

15–25 stocks across sectors

Sizing capped at 3–7% per position

Rebalanced annually

Why it works:

Microcap investing needs surface area — you’re playing a low-probability, high-payoff game

One or two 5x–10x winners can change your entire financial trajectory

Your edge only plays out if you take enough shots on goal

Who it’s for:

Investors with a stable income or existing core portfolio

High risk tolerance and long-term patience

At least a few years of investing experience

Deep understanding of business models, capital allocation, and valuation frameworks

This approach requires more than curiosity — it demands conviction, discipline, and time in the game.

But Here’s the Bigger Picture:

There are over 3,000+ microcap and SME stocks listed in India today.

And with one new SME IPO launching almost every day, this universe is expanding.

But here’s the uncomfortable truth:

Success lies in saying “no” more than saying “yes.”

Most SME and microcap businesses do not deserve your capital.

They’re often:

Structurally weak

Poorly governed

Built more for the promoter than for shareholders

That’s why we created our 20-Factor Microcap Scorecard — to act as a clear filter to help us say “no” to 95% of the noise.

Because at the end of the day, you don’t need to own everything.

You just need to own the right 10–15 businesses, size them right, and have the temperament to sit through the cycles.

Two Final Principles to Remember:

1. Let your winners ride Don’t exit just because a stock has doubled.

The real compounding happens after that.

2. Stomach the volatility — many multibaggers spend part of their journey 30–50% down before they turn.

Conviction is easy when things are green. It’s earned when they aren’t.

Final Thought

Stock picking is exciting.

Finding a multibagger is addictive.

But portfolios build wealth.

And in the world of microcaps, how you construct that portfolio — your bet sizes, your number of shots, your sell discipline — will determine whether, ten years from now, you’re telling war stories… or explaining why your 10-bagger didn’t move the needle.

So yes, celebrate your big winners. But measure your success in portfolio CAGR, not screenshots.

Because one 10x doesn’t matter… if your portfolio is a 1x.

And If You Made It This Far…

Thanks for reading.

If this post gave you a new lens to think about portfolio construction—or just made you pause and reflect on your investing mindset—I’d love to hear from you.

Tell me where you agree, where you don’t, or how you approach microcap portfolio construction differently. I genuinely enjoy learning from other thoughtful investors.

Have a topic in mind?

If there’s something you’d like me to write about—frameworks, case studies, deep dives, red flags, or tools—just say the word. Your suggestions shape what I publish next.

Want more posts like this?

Subscribe to get real-world investing frameworks, stock breakdowns, and raw thinking from the trenches—delivered straight to your inbox.

Thanks again for being here

Clear & succinct notes on how to approach Microcap stock universe...